20th Annual Transamerica Retirement Survey

Now in its 20th year, the study is one of the largest and longest-running of its kind. In late 2019, more than 5,200 workers were surveyed. It was supplemented with surveys April, June, and October 2020, each among 2,000 people to gauge the effects of the coronavirus pandemic on retirement confidence and workers' and retirees' outlooks. The robust, nationally representative samples enable TCRS to explore many different demographic segments among workers, employers, and retirees. TCRS’ research highlights opportunities to improve retirement security and ways everyone can better prepare and save for their financial futures.

The following research reports are available:

Retirement Security: A Compendium of Findings About U.S. Workers | October 2020 Supplemental Survey

|

December 18, 2020

Retirement Security: A Compendium of Findings About U.S. Workers is part of TCRS’ 20th Annual Transamerica Retirement Survey of Workers. The Compendium is based on a survey conducted in October 2020 and draws from a broader survey of workers conducted in late 2019. The Compendium provides in-depth perspectives on retirement planning-related activities, access to employer-sponsored retirement benefits, prevalence of debt among workers, retirement savings rates, and how workers have been impacted by the coronavirus pandemic. It offers demographic analyses and insights about workers by self-identified employment status (full-time vs. part-time), urbanicity, LGBTQ status, level of educational attainment, generation, gender, and race/ethnicity.

Chapters - Influences of Demographics on Retirement Readiness:

- U.S. Workers and Employment Status

- Urbanicity

- LGBTQ Status

- Educational Attainment

- Generation

- Gender

- Race/Ethnicity

Infographics - Retirement Security Priorities

- See All Infographics for Retirement Security Priorities

- U.S. Workers and Employment Status

- Urbanicity

- LGBTQ Status

- Educational Attainment

- Generation

- Gender

- Race/Ethnicity

|

Research Report

Download

Press Release

Download

Infographics

Download

Fact Sheet

Download

Share and Tag Us

on Twitter

@TCRStudies

|

Pre-Pandemic: U.S. Employer Benefits and Business Practices

|

December 23, 2020

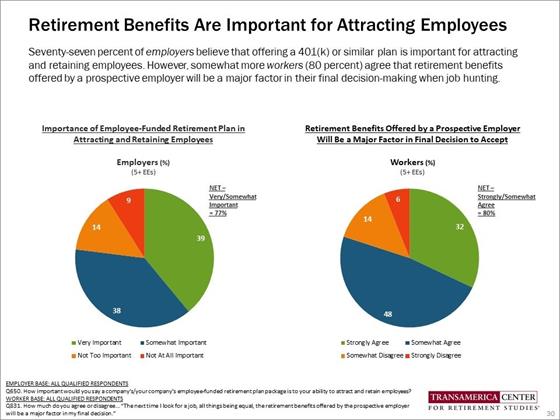

Employers tremendously influence workers’ ability to achieve a financially secure retirement. Their role encompasses the offering of retirement benefits, creating a welcoming environment for workers of all ages, fostering work-life balance, and adapting business practices to support transitions to retirement.

Pre-Pandemic: U.S. Employer Benefits and Business Practices quantifies retirement trends by company size -- small (less than 100 employees,) medium (100 to 499 employees), and large companies (500+ employees) -- and examines their business practices and benefit offerings that enable people to work, save, and transition into retirement. Based on surveys of employers and workers conducted in late 2019, before the onset of the coronavirus pandemic, this research report is also part of TCRS' 20th Annual Retirement Survey.

|

Research Report

Download

Share and Tag Us

on Twitter

@TCRStudies

|

Women and Retirement: Risks and Realities Amid COVID-19 | June 2020 Supplemental Survey

|

September 17, 2020

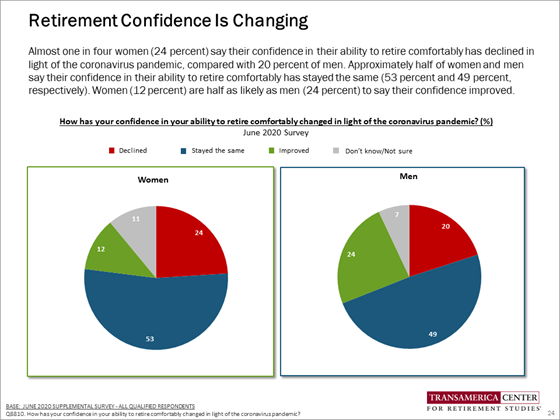

A woman’s path to a secure retirement is filled with obstacles and challenges that have intensified amid the pandemic. Women are being stretched to their limits, in some instances balancing their job responsibilities with home schooling children, and possibly, caregiving for an aging parent or loved one -- all of which can negatively impact her long-term financial situation. Right now, it is especially important for women to take care of themselves and their own well-being.

Women and Retirement: Risks and Realities Amid COVID-19 is based on findings from TCRS’ 20th Annual Retirement Survey, which comprises a supplemental survey conducted in June 2020 and a broader survey completed in late 2019. This report examines women’s finances before and during the pandemic, their expectations about retirement, and includes comparisons with men. It also offers actionable recommendations for improving outcomes in women’s long-term retirement preparedness.

|

Research Report

Download

Press Release

Download

Fact Sheet

Download

Share and Tag Us

on Twitter

@TCRStudies

|

Retirees and Retirement Amid COVID-19

|

September 3, 2020

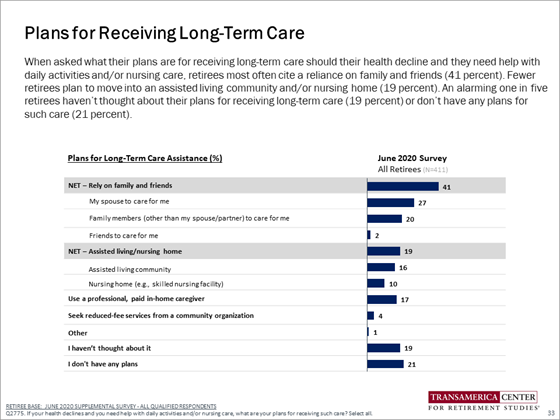

Retirees are vulnerable. Many live on fixed incomes, experience declines in health, lack resources to afford long-term care, and fear they may outlive their savings. The coronavirus pandemic has only exacerbated risks to their health and their financial well-being.

Retirees and Retirement Amid COVID-19 examines retirees' financial realities, life and living arrangements in retirement, when and how retirement happened, and looking back on financial preparations for retirement. Based on the 20th Annual Transamerica Retirement Survey and a June 2020 supplemental survey, it identifies issues and opportunities raised by the pandemic, and offers actionable insights for current and future retirees.

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies

|

Retirement Security for Women Amid COVID-19 | April 2020 Supplemental Survey

|

June 3, 2020

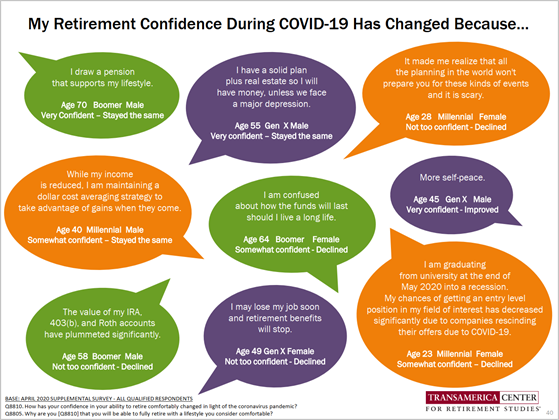

Women have historically been at greater risk of not achieving a financially secure retirement than men — a confluence of the persistent pay gap and time out of the workforce for parenting and caregiving. These factors make it extremely difficult to accumulate sufficient savings. However, the coronavirus pandemic and economic downturn have exacerbated women's financial vulnerabilities. In 2020 and onward, it is imperative that society recognizes women's unique challenges and bridge gender disparities.This research report is based on a supplemental survey conducted in April 2020.

|

Research Report

Download

Share and Tag Us

on Twitter

@TCRStudies

|

Retirement Security Amid COVID-19: The Outlook of Three Generations

|

May 19, 2020

Workers’ financial well-being has been persistently fragile – an issue of major concern that TCRS has been researching for 20 years. Now, the coronavirus pandemic and recession are further threatening workers’ retirement security and dreams. Its long-term implications have yet to be fully realized; however, the financial vulnerabilities are widespread across generations and becoming clear.

New TCRS report examines the financial impacts of pandemic and retirement risks faced by Millennials, Generation X, and Baby Boomers before and during the pandemic. It also provides opportunities to improve workers’ retirement prospects as they navigate through these unprecedented times. This research report is based on a survey conducted in late 2019 and offers comparisons with a supplemental survey conducted in April 2020.

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies

|