19th Annual Transamerica Retirement Survey

The study is one of the largest and longest-running of its kind. In 2018 more than 5,100 workers and1,800 employers were surveyed. The survey was conducted by The Harris Poll, an independent research company. The robust, nationally representative sample enables TCRS to explore many different demographic segments among workers and by company size among employers.

The following research reports are available:

A Compendium of Findings About U.S. Workers

|

December 19, 2019

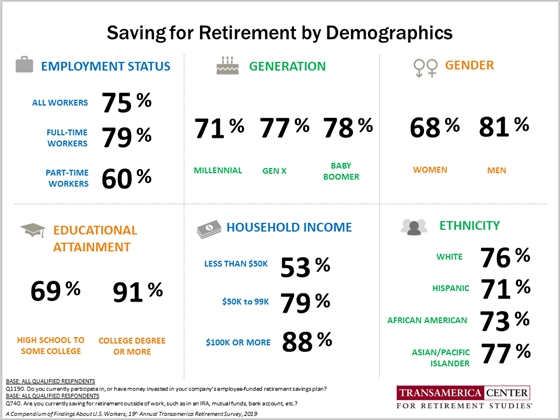

As part of its 19th Annual Transamerica Retirement Survey of Workers, TCRS presents, A Compendium of Findings About U.S. Workers. The Compendium provides an in-depth perspectives on retirement planning-related activities, access to employer-sponsored retirement benefits, prevalence of debt among workers, retirement savings rates, and how workers think their retirement will take place. This extensive report offers 30+ key indicators of retirement readiness, preparations and attitudes among workers by employment status (full-time/part-time), generation, gender, household income, level of education, and race/ethnicity.

Influences of Demographics on Retirement Readiness:

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies |

Nineteen Facts About Women and Retirement

|

November 14, 2019

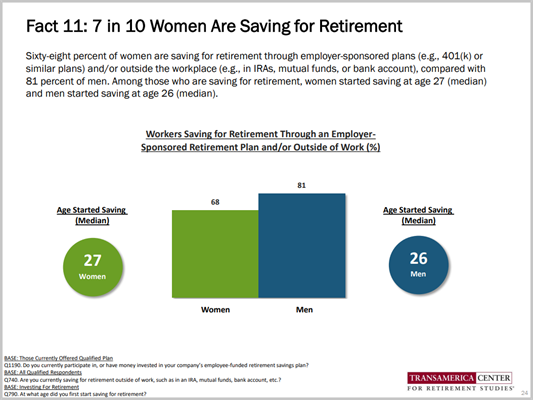

As part of its 19th Annual Transamerica Retirement Survey of Workers, TCRS presents, 19 Facts About Women’s Retirement Outlook, an examination women’s retirement preparedness. This is the 14th year that TCRS has published research showing that women are at a greater risk of not achieving a financially secure retirement compared to men. This study covers research of more than 3,000 women workers in the U.S. and provides insights to their retirement outlook. With this study, TCRS aims to raise awareness of the retirement risks that women face and highlight opportunities where women can take greater control of their long-term financial security. Click to expand image.

|

Research Report

Download

Press Release

Download

Fact Sheet

Download

Hoja de datos en español

Download

Share and Tag Us

on Twitter

@TCRStudies |

Employers: The Retirement Security Challenge

|

October 2, 2019

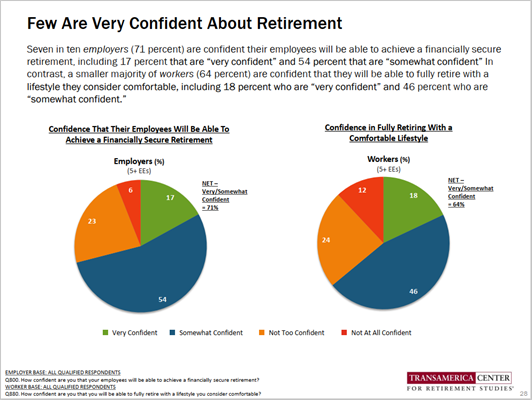

Employers: The Retirement Security Challenge explores the vital societal role that employers play in helping workers achieve long-term financial security. It examines employers’ perspectives, business practices, and benefit programs that enable employees to work, save, and transition into retirement. At a time when fewer than one in five workers (18 percent) are very confident they will be able to fully retire with a comfortable lifestyle, and a similar percentage of employers (17 percent) are very confident that their employees will be able to achieve a financially secure retirement, this report highlights opportunities for employers to do even more to help workers prepare.

As part of its 19th Annual Retirement Survey, TCRS surveyed more than 1,800 employers of for-profit companies with five or more employees to gain insights into how they are supporting their employees. The survey findings are presented in aggregate and by company size, including small (5 to 99 employees), medium (100 to 499 employees), and large companies (500+ employees). The study also provides relevant comparisons to TCRS’ survey of workers. Click to expand image.

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies |

Self-Employed: Defying and Redefining Retirement

|

July 24, 2019

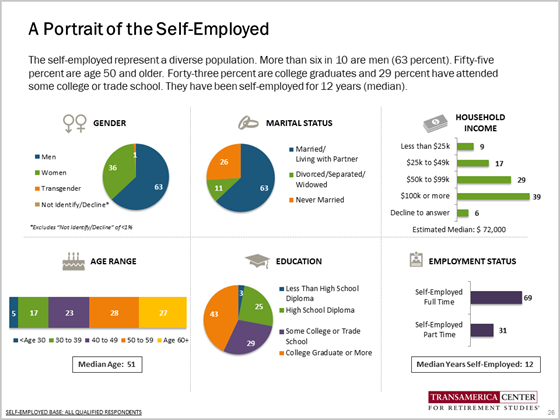

Unfettered by employers that can profoundly influence when and how they will retire, many self-employed workers have a strong vision of retiring on their own terms. Given the autonomy and flexibility in their work situations, many intend to work beyond traditional retirement age, while others have no intentions of ever retiring. While self-employment can bring about greater autonomy and flexibility, many self-employed workers may be overlooking essential components of retirement preparation.

TCRS research explores the unique opportunities and challenges for saving, planning, and preparing for retirement that self-employed workers face. Without retirement benefits offered by an employer, the self-employed must take a do-it-yourself approach to preparing for retirement. This report offers valuable insights to assist the retirement preparation process, such as the importance utilizing of tax-advantaged retirement savings opportunities, developing a written retirement strategy, and taking proactive steps to protect one’s ability to work.

The report compares the retirement outlook of 755 respondents who self-identify as self-employed with 5,168 who are traditionally employed. Below is a portrait of the self-employed and the diversity of the population. Click to expand image.

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies |

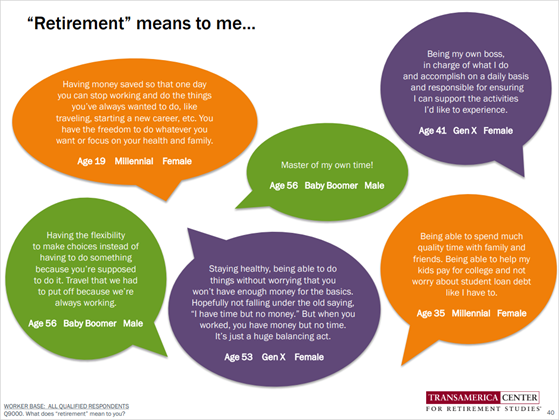

What Is "Retirement"? Three Generations Prepare for Older Age

|

April 3, 2019

Retirement means "freedom" – a common thread weaving together Baby Boomers, Generation X, and Millennials in the workforce. Yet, simultaneously, people are grappling with how they will achieve financial success in older age. In an era in which people have the potential to live longer than any other time in history, how can we as a society fundamentally redefine retirement and our life journeys leading up to it? How can we create flexibility so people can retire on their own terms?

New TCRS research explores three generations’ visions of aging and what “retirement” personally means to them; their financial preparations, steps toward safeguarding their long-term health and happiness, and work-life balance. This report also provides insights into the vital role of employers in helping workers prepare for older age, such as the value of offering workplace retirement benefits, employee education about the Saver's Credit and catch-up contributions, support for work-life balance and alternative work arrangements, among many other opportunities.

The 19th Annual Transamerica Retirement Survey asked 5,923 full- and part-time workers, what "retirement" personally means to them. Below is a curation of their real responses. Click to expand image.

|

Research Report

Download

Press Release

Download

Share and Tag Us

on Twitter

@TCRStudies

|